Turkey has long been recognized as a vibrant hub bridging Europe and Asia, offering immense opportunities for entrepreneurs. With its strategic location, young population, and dynamic market, Turkey has become a hotspot for foreign investors. Whether you’re a seasoned entrepreneur or just starting your journey, establishing a business in Turkey requires understanding the legal, financial, and cultural landscape. Here’s a detailed guide to help you navigate the process.

Understand the Market Landscape

Before jumping into any business venture, understanding the market you’re entering is crucial. Turkey boasts a diverse economy that spans industries such as technology, manufacturing, tourism, real estate, and agriculture. Begin by identifying the sector that aligns with your expertise or interests.

For instance, if you’re looking to invest in technology, cities like Istanbul and Ankara offer a growing ecosystem of startups and tech hubs. On the other hand, if your focus is on agriculture, Turkey’s fertile lands provide opportunities in export-driven farming and food processing industries.

Additionally, studying consumer behavior is essential, as Turkey’s young and tech-savvy population heavily influences market trends. Leverage local market research agencies, connect with industry experts, or participate in trade fairs to gain actionable insights.

Decide on the Business Structure

Turkey offers various business structures, each with its own legal and financial implications. The most common types for foreign investors are:

- Limited Liability Company (LLC): A popular option due to its limited risk and straightforward setup. It requires a minimum capital of 50,000 TRY.

- Joint-Stock Company (JSC): Ideal for larger investments and projects with higher risks, requiring at least five shareholders and a minimum capital of 250,000 TRY.

- Branch Office: If you already have an established business overseas, opening a branch can simplify entry into the Turkish market.

- Liaison Office: Perfect for businesses that want to explore the market before making a full commitment, though it cannot generate income.

Choose a structure that suits your investment goals, financial capacity, and growth plans. Consulting with a local legal expert can make this process smoother and ensure compliance with Turkish laws.

Learn the Legal Requirements

Navigating the legal framework is one of the most critical aspects of establishing a business in Turkey. To officially register your company, you will need:

- A Tax Identification Number: This is essential for all financial and legal transactions.

- Trade Registry Application: Submit the required documents, including notarized articles of association, at the local Trade Registry Office.

- Bank Account Setup: Open a business bank account to deposit the minimum required capital. You’ll also need to register with the Social Security Institution (SGK) and obtain permits specific to your industry, such as environmental or operational licenses.

- Pro Tip: Partnering with a legal advisor familiar with Turkish business law can save you significant time and effort.

Understand Taxation and Financial Regulations

Turkey’s tax system is business-friendly but requires thorough understanding. Businesses are subject to several types of taxes, including corporate income tax (25% standard rate), value-added tax (20% for most goods and services), and withholding taxes on dividends, interest, and royalties.

To ensure compliance:

- Keep detailed records of all transactions.

- Work with a certified accountant to handle tax declarations and financial reporting.

- Familiarize yourself with incentives and exemptions available to foreign investors, such as those offered in free zones or for technology-based ventures.

Find the Right Location

Turkey’s vast geography means each region offers unique opportunities and challenges. Cities like Istanbul, Ankara, and Izmir are ideal for businesses seeking metropolitan markets, while regions like the Aegean or Southeast Anatolia are more suitable for agriculture or manufacturing.

Consider factors such as proximity to suppliers, customer base, infrastructure, and cost of living when deciding your location. Many entrepreneurs also consider setting up in one of Turkey’s free zones, which offer tax and customs duty exemptions.

Build Local Partnerships

One of the smartest moves you can make as a foreign entrepreneur in Turkey is to establish strong local connections. Partnering with local businesses, consultants, or organizations helps you navigate cultural nuances and understand consumer expectations better. Furthermore, having a Turkish partner can simplify bureaucratic processes and open doors to local networks. Networking events, chambers of commerce, and industry-specific associations are great places to start building connections.

Adapt to the Culture and Language

Understanding Turkish culture and language can significantly impact your success. Turks value personal relationships and trust, which are essential in business dealings. Learning basic Turkish phrases or hiring bilingual staff can improve communication and foster goodwill.

Cultural adaptation also extends to marketing strategies. Tailoring your brand messaging to resonate with Turkish consumers’ values, such as family, community, and tradition, can make a significant difference.

Develop a Business Plan

No business can succeed without a solid plan. Your business plan should include:

- Market analysis

- Competitor insights

- Financial projections

- Marketing strategy

- Risk assessment

Having a detailed plan not only helps you stay focused but is often required when applying for business loans or pitching to investors in Turkey.

Stay Updated on Economic and Political Changes

Turkey’s dynamic political and economic environment can influence your business decisions. Keep an eye on inflation rates, currency fluctuations, and regulatory changes. Subscribing to local business news, joining professional forums, and working with consultants can help you stay informed and proactive.

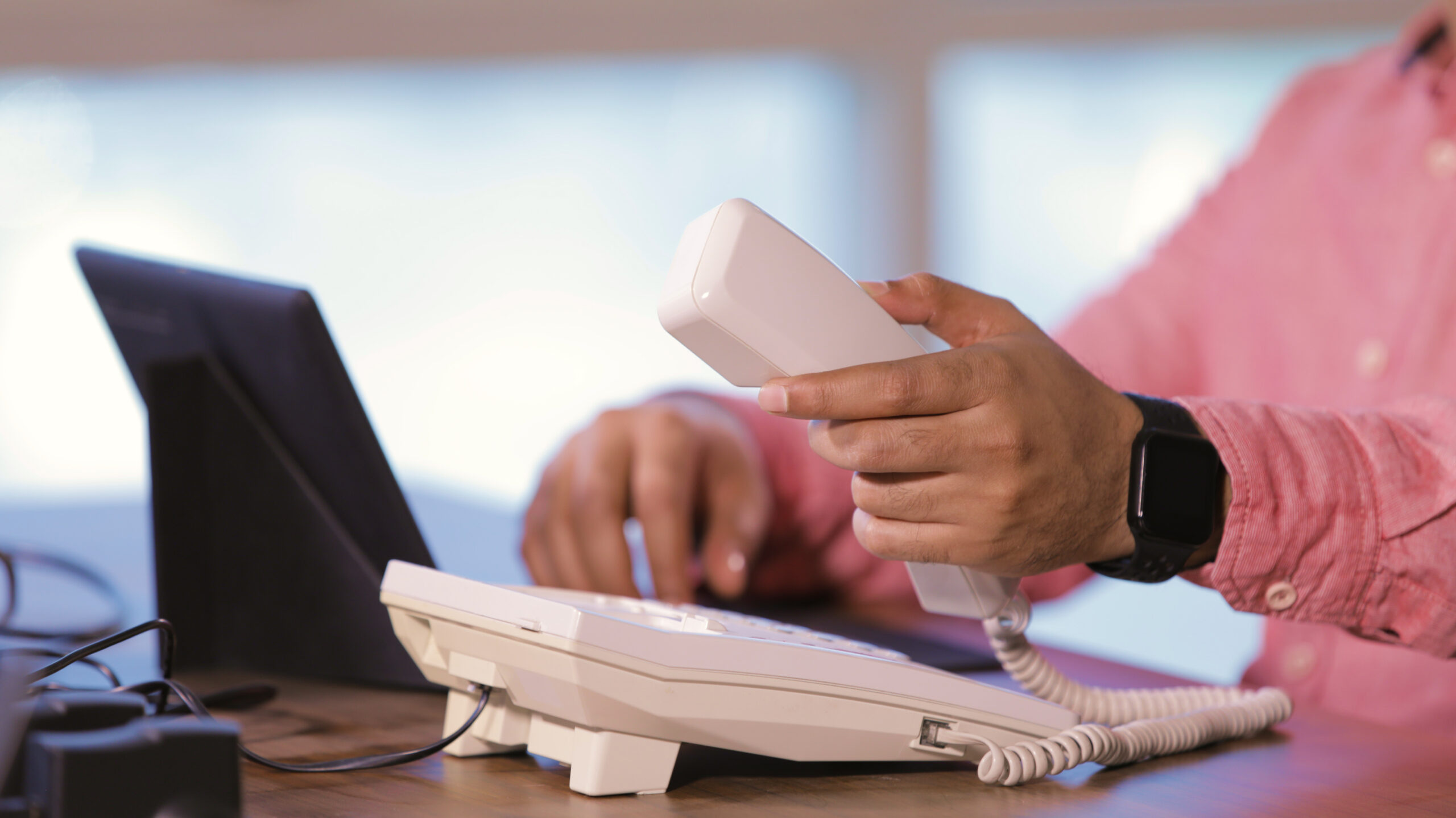

Leverage Professional Support

While it’s possible to navigate the process independently, seeking professional guidance often leads to faster and more successful outcomes. Lawyers, accountants, and business consultants familiar with Turkey’s regulatory environment can help avoid costly mistakes and delays.

Where to Start?

Starting a business in Turkey requires navigating legal processes, but with the right guidance, it can be a smooth and seamless experience. If you need comprehensive support with company registration, compliance management, or setting up a virtual office, Workon offers complete business support services. Explore our Business Starter Package and receive a free consultation on your company formation process.

Yes, foreigners can own 100% of a business in Turkey with no restrictions, as long as legal requirements are met.

LLC (50,000 TRY minimum capital)

JSC (250,000 TRY minimum capital)

Costs range from $1,500 to $3,000 USD, including registration, legal fees, and basic setup.

Typically, it takes 5 business days (Workon's standard processing time), provided all required documents are complete and submitted.

Yes, including free zones, R&D incentives, and VAT exemptions for strategic investments.

Not mandatory, but helpful. Hiring bilingual staff or working with translators is recommended.