Navigating Turkey’s VAT System: The Essentials

Turkey’s Value Added Tax (VAT), known locally as Katma Değer Vergisi (KDV), is a consumption tax applied to most goods and services. It’s a core element of the country’s fiscal policy and a major source of government revenue. While similar to European VAT models, the Turkish system has unique characteristics vital for businesses operating in or entering the Turkish market.

Understanding the Importance of VAT in Turkey

KDV is fundamental to Turkey’s public finances. Taxes on goods and services, including VAT, made up 47.4% of Turkey’s total government revenue in 2022. This demonstrates the significant role of consumption-based taxation in the country’s fiscal strategy. This reliance on indirect taxes like VAT contrasts with the more balanced approach of many OECD countries. For further details, see: Trading Economics

The KDV system has seen several reforms over time, impacting compliance and business strategies. These changes reflect the government’s efforts to optimize the system and adapt to economic conditions. Keeping up-to-date with the latest regulations is essential for compliance and informed decision-making.

Administration and Collection of VAT

The Revenue Administration of Turkey (Gelir İdaresi Başkanlığı) manages KDV administration and collection. This body ensures efficient tax collection, enforces regulations, and offers guidance to businesses. Their oversight is key to maintaining the VAT system’s integrity.

Businesses must interact with the Revenue Administration for registration, filing returns, and clarifying VAT matters. Understanding the registration process, for example, is a crucial first step for VAT-liable businesses. A clear understanding of the administrative structure simplifies compliance and interaction with the authorities.

Key Features of the Turkish VAT System

Several key features define Turkey’s VAT system:

- Multi-Rate Structure: Turkey uses a multi-rate system, applying different rates to different goods and services. Accurate product classification is vital for applying the correct rate.

- Exemptions and Zero-Rating: Some goods and services are exempt from VAT or zero-rated. This supports specific sectors or eases the tax burden on essential items.

- E-Invoicing and Digital Compliance: Turkey has implemented e-invoicing and digital reporting for VAT, increasing transparency and efficiency. These digital systems streamline compliance and record-keeping.

- Refunds and Reclaims: Businesses can reclaim input VAT paid on purchases linked to their taxable supplies. This mechanism prevents double taxation and improves cash flow management.

Successfully navigating these elements is critical for businesses to optimize their tax strategy, minimize compliance risks, and contribute to the Turkish economy. The following sections will explore these aspects in more detail, offering practical guidance and insights to help you master VAT in Turkey.

Breaking Down VAT Rates in Turkey: What You’ll Pay

Understanding Turkey’s Value Added Tax (VAT), or Katma Değer Vergisi (KDV), is essential for businesses operating in the country. The three-tiered system directly impacts pricing strategies and profitability. Let’s explore these rates and their application to various goods and services.

The Standard Rate: 20%

The most frequently applied rate is 20%. This standard rate encompasses a wide array of goods and services, from everyday consumer items like electronics and clothing to professional services such as consulting. Accurate record-keeping is vital for businesses to manage this standard KDV component effectively.

Reduced Rates: 10% and 1%

Turkey also implements reduced VAT rates of 10% and 1% for specific goods and services considered essential or socially important. The 10% rate generally applies to basic food items, agricultural products, and some tourism services. The 1% rate, the lowest in the system, applies to specific medications and other basic necessities. This tiered system helps manage the cost of living for consumers.

This nuanced approach has a considerable impact on pricing. For example, a luxury car is subject to the 20% KDV, while essential food items like bread or milk benefit from the reduced 10% rate. This difference in rates highlights the influence of KDV on daily consumer spending.

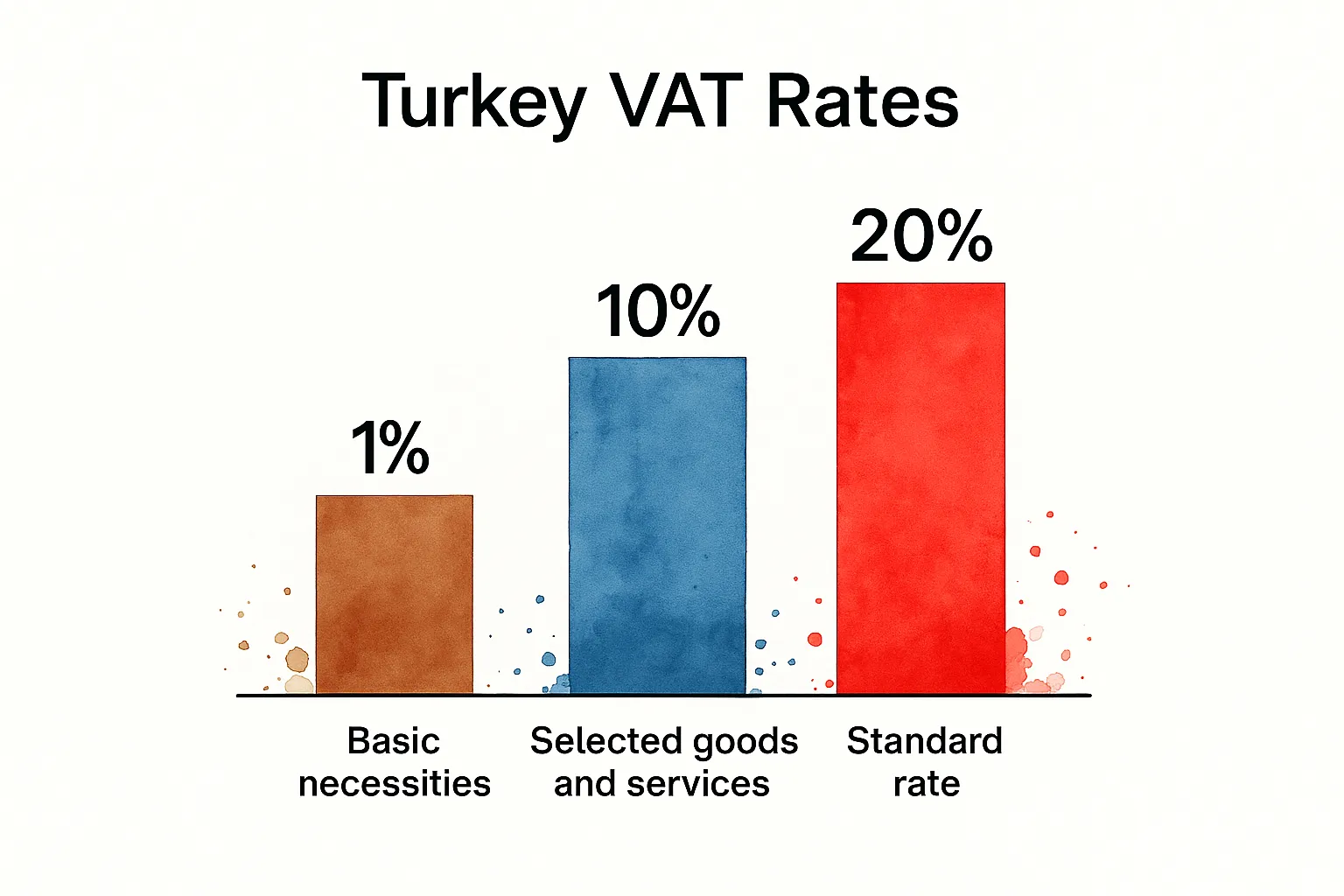

Visualizing VAT Rates: A Data Chart

The following data chart visually represents the distribution of goods and services across the different VAT rates (1%, 10%, and 20%) in Turkey. This bar chart offers a clear picture of how frequently each rate is applied.

As the data chart demonstrates, a significant majority of goods and services in Turkey are subject to the 20% standard VAT rate. The reduced rates of 10% and 1%, while applying to fewer goods and services, play a vital role in maintaining affordability for essential items. This balance is a key factor in the Turkish economy.

Sector-Specific Considerations

Different sectors have unique VAT considerations. The tourism industry, for instance, benefits from the 8% rate on accommodation services, while real estate transactions generally fall under the 20% standard rate. Understanding these sector-specific nuances is critical for effective financial planning and competitive pricing within the Turkish market. Businesses must carefully integrate these rates into their financial strategies.

VAT Rates in Turkey by Product/Service Category

To further illustrate the application of VAT rates, the following table provides a detailed breakdown by product/service category:

| Product/Service Category | VAT Rate | Examples | Notes/Special Conditions |

|---|---|---|---|

| Basic Foodstuffs | 10% | Bread, milk, eggs | May vary depending on specific product |

| Luxury Goods | 20% | Jewelry, high-end electronics | |

| Accommodation Services | 10% | Hotels, holiday rentals | Primarily for tourism purposes |

| Medical Supplies | 1% | Certain prescribed medications | Subject to specific regulations |

| Consulting Services | 20% | Financial advice, legal counsel | |

| Agricultural Products | 10% | Raw produce, livestock | Supports the agricultural sector |

This table provides a general overview. Businesses should consult official resources for specific classifications and any applicable exemptions.

Understanding these VAT distinctions is essential for businesses to accurately calculate KDV liabilities and operate successfully within the Turkish tax system. It forms a critical component of financial management for any business operating within Turkey.

VAT Exemptions in Turkey: Uncovering Tax-Saving Opportunities

Savvy businesses operating in Turkey understand that VAT exemptions are more than just a compliance issue; they’re a strategic tool for optimizing tax liabilities. This section clarifies Turkey’s VAT exemption framework, highlighting the key difference between full exemptions, where no VAT is applied, and zero-rated supplies, where businesses can reclaim input VAT. Understanding this distinction is crucial for accurate financial planning and forecasting.

Full Exemptions: Specific Goods and Services

Full VAT exemptions apply to a select group of goods and services considered essential or socially beneficial. This includes certain healthcare services, educational activities, and cultural events. For instance, treatments at private hospitals often fall under this exemption, significantly reducing the cost for patients. Certain financial transactions and insurance premiums may also be exempt.

Zero-Rated Supplies: Boosting Exports

Zero-rated supplies play a crucial role in supporting Turkish exports. This category primarily covers goods and services exported outside Turkey. This means Turkish exporters don’t include VAT on their invoices, boosting their competitiveness in the global market. Importantly, exporters can still reclaim the input VAT paid on expenses related to these exports, providing a significant cash flow advantage. This mechanism actively promotes Turkey’s participation in international trade.

Sector-Specific Exemptions: Targeted Relief

Specific sectors benefit from targeted VAT exemptions. The healthcare industry, for example, sees exemptions for certain medical equipment and pharmaceuticals. Similarly, the education sector benefits from exemptions for certain educational materials and courses. These sector-specific exemptions aim to bolster essential services and improve their accessibility for the Turkish population.

Special Economic Zones: Opportunities for Growth

Turkey uses special economic zones to encourage investment and economic development. These zones frequently offer VAT exemptions or reduced rates for businesses operating within their designated areas. This incentivizes both domestic and international investment, creating jobs and fostering economic activity. Understanding the specifics of these zones can unlock substantial tax benefits for eligible businesses. The VAT system has a considerable impact on value-added industries, contributing 11.76% in 2022. Turkey’s position in the International Tax Competitiveness Index reflects the ongoing efforts to balance VAT efficiency and economic growth. Learn more about Turkey’s tax system: Tax Foundation – Turkey

Recent Legislative Changes: Staying Informed

Turkey’s VAT regulations are subject to change according to economic conditions and government policy. Recent legislative changes have both broadened and narrowed specific exemption categories. Businesses must stay updated on these changes to maintain compliance and adapt their tax strategies. Working with tax professionals can help navigate these complex regulations and maximize tax benefits within the legal framework. A deep understanding of these exemptions enables businesses to effectively manage VAT and enhance their financial performance in Turkey’s dynamic market.

Mastering VAT Compliance: Registration to Reporting

Simplifying Value Added Tax (VAT), or KDV as it’s known in Turkey, can feel like navigating a complex maze. This guide breaks down the entire process, from initial registration to the ongoing requirements for reporting.

Determining Your VAT Obligations

Understanding when to register for VAT is the crucial first step. For resident businesses operating in Turkey, registration becomes mandatory when your annual turnover surpasses the threshold defined by the Revenue Administration. This threshold is subject to periodic adjustments, so staying up-to-date with the latest regulations is essential. Non-resident businesses engaging in taxable activities within Turkey, however, are required to register for VAT irrespective of their turnover.

Navigating the Registration Process

Once you’ve confirmed your VAT obligation, the next stage is the registration process itself. This application is submitted through the Revenue Administration and involves providing specific documentation and details about your business operations. Thorough preparation is key, as this can be a detailed process. Workon, a business services provider, can assist in streamlining your registration, minimizing potential complications.

Invoice Requirements and Record-Keeping

Accurate invoicing forms the bedrock of VAT compliance. Turkish tax authorities mandate strict adherence to specific invoice requirements, including mandatory information that must be displayed on each document. This meticulous approach helps prevent discrepancies and ensures accurate reporting. Maintaining comprehensive records of all invoices, both issued and received, is equally critical. Proper record-keeping supports accurate VAT returns and facilitates smoother audits.

Meeting Filing Deadlines and Reporting

Turkey enforces strict deadlines for filing VAT returns. Failing to meet these deadlines can result in penalties. Businesses should implement a robust system for tracking, preparing, and submitting VAT returns promptly. This proactive approach avoids last-minute rushes and ensures continued compliance. Accurate and timely reporting is fundamental to maintaining a positive standing with the tax authorities.

Embracing E-Invoicing and Digital Compliance

Turkey has implemented e-invoicing standards and digital compliance measures for VAT. This digital transformation improves transparency and efficiency for both businesses and tax authorities. E-invoicing simplifies reporting and streamlines record-keeping processes. Understanding and integrating these digital requirements into your business operations is crucial for long-term compliance.

Establishing Proper VAT Governance From Day One

Setting up a solid VAT governance framework from the outset is essential for maintaining ongoing compliance. This includes establishing clear internal policies, designating responsible personnel for VAT-related matters, and potentially collaborating with external tax advisors. A well-defined VAT governance structure ensures consistent adherence to regulations, minimizing the risk of errors and potential penalties. This proactive approach frees businesses to focus on core operations while maintaining full VAT compliance. Contact Workon for guidance on establishing a comprehensive VAT compliance strategy.

Recovering Your Money: VAT Refunds That Actually Work

Reclaiming your Value Added Tax (VAT), also known as Katma Değer Vergisi (KDV) in Turkey, can significantly boost your business’s cash flow. This section explores how to successfully navigate the KDV refund system, highlighting often-overlooked eligibility criteria and essential documentation.

Who Qualifies for VAT Refunds?

Several business types can claim VAT refunds:

- Turkish Companies: Businesses with excess input VAT due to zero-rated supplies, like exports, are eligible. This mechanism supports exporters and promotes international trade.

- Foreign Businesses: Non-resident businesses incurring VAT on Turkey-related business expenses can often reclaim these amounts. This encourages foreign investment and ensures fair tax treatment.

- Tourist Shoppers: Tourists buying goods in Turkey can receive VAT refunds on certain purchases upon leaving the country. This stimulates tourism and boosts the local economy.

Understanding the Documentation Requirements

A successful VAT refund application relies on accurate and complete documentation. Key documents include:

- VAT Invoices: These must clearly display the VAT amount paid. Organized invoice records are crucial.

- Proof of Export: For exporters, proving goods have left Turkey is essential, often requiring shipping documents or customs declarations.

- Application Forms: Specific forms, available from the Revenue Administration, must be accurately completed and submitted. Attention to detail here avoids delays.

VAT Refund Procedures: Case Studies

Let’s illustrate the refund procedures with practical examples:

- Turkish Exporter: A Turkish textile company exporting to Europe can reclaim input VAT paid on materials, production costs, and even specific operational expenses linked to exported products. This enhances their international competitiveness.

- Foreign Consultant: A foreign consulting firm serving a Turkish client can reclaim VAT paid on expenses incurred in Turkey while delivering those services.

- Tourist Purchasing Carpets: A tourist buying handmade carpets in Turkey can reclaim the VAT paid at the airport upon departure, provided they have the correct documentation and follow the tourist refund procedures.

Accelerating Your Refund and Overcoming Obstacles

Several strategies can expedite the refund process:

- Accurate Record-Keeping: Meticulous records from the start minimize processing time and potential issues with tax authorities.

- Digital Submission: Using Turkey’s e-invoicing and digital reporting systems simplifies the application process.

- Professional Assistance: A company like Workon can simplify the entire process, ensuring compliance and efficient document handling.

Even with careful preparation, challenges can occur:

- Missing Documentation: Ensure your application includes all necessary documents, as even small omissions can cause significant delays.

- Incorrect Information: Double-check all details for accuracy. Application errors can lead to rejection or extended processing.

- Processing Delays: While Turkey has improved wait times, delays can still happen. Patience and follow-up with the Revenue Administration might be necessary.

System Improvements and Future Trends

Turkey has implemented system enhancements to boost VAT refund efficiency, focusing on digitalization and simplified procedures to reduce wait times and streamline the process. Resource taxes, part of Turkey’s taxes on goods and services, reached 13.7 billion Turkish lira in 2022, highlighting the increasing fiscal importance of natural resources. Learn more about resource taxes: Statista These ongoing efforts are essential for supporting economic activity and making VAT refunds a reliable cash flow tool.

Foreign Business Guide: VAT in Turkey Without Headaches

Navigating the Turkish VAT system can be complex for foreign businesses. However, a clear understanding of the specific rules and regulations can simplify compliance significantly. This guide outlines key aspects of Value Added Tax (VAT), known as KDV in Turkey, for non-residents operating within the country.

VAT Registration For Foreign Businesses

Foreign businesses conducting taxable activities in Turkey are required to register for VAT, irrespective of their annual turnover. This differs from resident businesses, who must register only if their turnover exceeds a specified threshold. Registration with the Revenue Administration of Turkey (Gelir İdaresi Başkanlığı) involves submitting specific documentation and understanding the application process. Workon can help foreign businesses manage this registration.

This mandatory registration for all foreign businesses, even those with smaller operations, is a key difference to be aware of. It emphasizes the importance of early preparation and understanding of the Turkish VAT system.

B2B Vs. B2C Transactions: VAT Implications

Differentiating between Business-to-Business (B2B) and Business-to-Consumer (B2C) transactions is crucial for correct VAT application. For B2B transactions within Turkey, the standard 20% VAT rate generally applies. However, specific rules may exist for transactions within the European Union. For B2C transactions, the standard rate also applies, along with reduced rates of 10% or 1% for certain eligible goods and services.

Digital Services and Distance Selling Thresholds

Digital services offered by foreign businesses to Turkish consumers are subject to VAT in Turkey. This is an important consideration for tech companies operating internationally. Similarly, distance selling thresholds are in place. This means that if a foreign business sells goods to Turkish consumers and exceeds a specific sales volume, they become VAT liable in Turkey, even without a physical presence. These regulations ensure fair competition between local and international businesses.

VAT and Different Business Models

VAT application varies depending on the business model:

- Import/Export Operations: Exports are typically zero-rated, allowing businesses to reclaim input VAT. Imports are subject to VAT at the point of entry into Turkey.

- Service Provision: Services delivered in Turkey by foreign businesses are generally subject to the standard 20% VAT, unless specific exemptions apply.

- E-commerce Sales: VAT on e-commerce sales adheres to the B2B and B2C distinctions, with additional factors related to distance selling thresholds and digital service regulations.

VAT Obligations: Foreign Vs. Domestic Businesses

The following table summarizes the core VAT obligations for foreign and domestic businesses in Turkey:

To help illustrate the key distinctions between VAT obligations, let’s look at a comparison table. This will clarify the specific requirements for both foreign and domestic entities operating in Turkey.

| Requirement | Foreign Businesses | Domestic Businesses | Key Differences |

|---|---|---|---|

| Registration | Mandatory for taxable activities regardless of turnover | Mandatory if annual turnover exceeds a defined threshold | The turnover threshold for registration applies only to domestic businesses. |

| Fiscal Representation | May be required | Not required | Foreign businesses may need a fiscal representative to handle VAT obligations. |

| Reporting | Similar reporting requirements, including e-invoicing | Similar reporting requirements, including e-invoicing | Both business types are subject to the same digital reporting requirements. |

As the table highlights, a core difference lies in the registration requirements. While all foreign businesses engaged in taxable activities must register, regardless of turnover, domestic businesses have a turnover threshold. Another key difference is the potential need for fiscal representation for foreign businesses.

By understanding these key VAT aspects, foreign businesses can operate confidently within Turkey’s regulatory framework and reduce compliance risks. Workon offers expert guidance on all aspects of Turkish VAT compliance, assisting businesses in successfully navigating the complexities of the system.

The Future of VAT in Turkey: Trends You Need to Know

Turkey’s VAT system is dynamic, constantly evolving to reflect economic conditions and global trends. Understanding these shifts is crucial for businesses to anticipate changes and adapt proactively, rather than simply reacting. This forward-thinking approach allows for better strategic planning and more effective implementation.

Digitalization of VAT Administration

The Turkish Revenue Administration is increasingly adopting digital solutions. This digitalization is transforming VAT administration, streamlining processes such as registration, filing, and refunds. The shift to e-invoicing, for example, is a significant step towards a fully digital VAT system. This emphasis on technology aims to improve transparency and reduce the compliance burden on businesses.

Harmonization With International Standards

Turkey is actively aligning its VAT system with international norms. This includes efforts to harmonize regulations and procedures with other countries and international organizations. This harmonization is essential for businesses involved in international trade. It simplifies cross-border transactions and fosters a more consistent global tax environment.

Impact of Economic Policies

Turkey’s economic policies directly influence the VAT landscape. Government initiatives designed to stimulate growth or address economic challenges can result in adjustments to VAT rates, exemptions, or other system components. For instance, reduced VAT rates may be applied to specific goods to encourage consumer spending during economic downturns. Keeping abreast of broader economic policies is therefore critical for understanding potential VAT changes.

Industry-Specific Developments

Different industries are experiencing unique VAT-related changes. Some sectors may see new regulations, adjusted rates, or specific exemption opportunities. The digital services industry, for example, is a key area for evolving VAT rules due to the growth of online transactions. Businesses should closely monitor developments within their specific sector to understand how future changes may affect their operations.

Global Tax Trends and Their Influence

Global tax trends, such as the increasing focus on transparency and efforts to combat tax avoidance, are shaping Turkey’s approach to VAT. These international trends can lead to changes in domestic regulations. For instance, there may be stricter reporting requirements or increased scrutiny of cross-border transactions. Awareness of global tax developments helps businesses anticipate how these might influence Turkey’s VAT policy.

Ready to simplify your VAT compliance in Turkey and stay ahead of the curve? Contact Workon for expert guidance and support.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute legal, financial, or tax advice. While efforts have been made to ensure accuracy at the time of writing, laws and regulations may change, and certain details may vary depending on individual circumstances. Readers are strongly advised to consult with a qualified legal, financial, or tax professional before making any decisions based on the content of this article. Workon assumes no responsibility for actions taken based solely on this information.