Navigating Turkey’s Customs Landscape: What You Need to Know

Turkey, strategically located between Europe and Asia, offers both unique challenges and advantages for businesses involved in international trade. Understanding the intricacies of Turkish customs regulations is essential for smooth and efficient import and export operations. This includes not only staying informed about current regulations but also adapting to the ever-changing international trade landscape that shapes Turkey’s customs clearance procedures.

Understanding the Turkish Customs Administration

The Turkish Customs Administration (TCA) plays a critical role in overseeing the movement of goods across Turkey’s borders. It is responsible for enforcing customs laws, collecting duties and taxes, and facilitating legitimate trade activities. Effectively navigating the TCA’s framework requires a solid understanding of its organizational structure, various departments, and the specific procedures for different product categories. This knowledge is crucial for minimizing potential delays and ensuring compliance with all regulations.

Adapting to Regulatory Changes

The Turkish customs landscape is dynamic, with new regulations and amendments introduced regularly. For instance, in 2025, reforms were implemented to strengthen declaration requirements. The allowable number of shipments per customs declaration was reduced from 2,000 to 500 to enhance oversight and control. This change significantly impacted high-volume importers and e-commerce businesses, necessitating adjustments to their declaration processes. These updates emphasize the importance for businesses to stay updated on regulatory changes and proactively modify their operations to maintain efficiency.

Trade Data Reflects the Need for Adaptability

In January 2025, Turkey’s exports totaled $19.277 billion, representing a 7.5% year-over-year increase, while imports reached $26.932 billion under the special trade system. By March 2025, exports further increased to $21.355 billion (a 3.4% rise), with imports at $29.202 billion. These figures demonstrate Turkey’s significant and growing trade volume, further underscoring the need for streamlined and adaptable customs procedures. Find more detailed statistics here

Impact of International Trade Agreements

Turkey’s involvement in various international trade agreements and its evolving relationships with other nations have a considerable impact on its customs regulations. These agreements can result in preferential tariffs, simplified clearance procedures, or specific documentation needs. Understanding how these agreements affect your particular products and target markets is crucial for developing an optimal customs clearance strategy. Staying informed about any changes in these international alliances is equally important for anticipating potential effects on your business.

Practical Tips for Navigating Turkish Customs

Successfully managing Turkish customs requires a proactive and well-informed approach. Consider these key recommendations:

- Maintaining meticulous records: Detailed records of all transactions, documents, and interactions with customs officials are vital for demonstrating compliance and addressing any potential discrepancies.

- Building strong relationships with customs brokers: Experienced customs brokers can offer valuable guidance, navigate complex procedures, and effectively represent your interests when dealing with the TCA.

- Utilizing digital platforms: Becoming familiar with and efficiently using Turkey’s digital documentation platforms can significantly improve the customs clearance process.

By understanding the nuances of the Turkish customs landscape and implementing proactive strategies, businesses can ensure smooth customs clearance, minimize delays, and optimize their import and export operations.

Documentation Mastery: The Foundation of Successful Clearance

Accurate documentation—like bills of lading, invoices, and permits—is key to successful customs clearance in Turkey.

Successfully navigating customs clearance in Turkey depends on having accurate and complete documentation. Even a small mistake can cause significant delays and extra costs. This section explains the necessary paperwork and best practices for a smooth import process.

Essential Documents For Turkish Customs

Several vital documents are always required for customs clearance in Turkey. These include the commercial invoice, detailing the transaction between buyer and seller. You’ll also need the bill of lading, which serves as a receipt for the goods and proof of ownership. Finally, the certificate of origin verifies where the goods were manufactured.

Depending on the specific products you’re importing, additional licenses, permits, or certificates might be necessary. For instance, agricultural imports often require phytosanitary certificates.

To help you prepare, we’ve compiled a table summarizing the key documents:

Understanding the documentation requirements beforehand can save you time and potential headaches.

Required Documentation for Turkish Customs Clearance

Comprehensive list of essential documents needed for different types of goods when clearing customs in Turkey.

| Document Type | Required For | Processing Time | Special Requirements |

|---|---|---|---|

| Commercial Invoice | All goods | Immediate | Must match other documentation |

| Bill of Lading | All goods | Immediate | Original or certified copy required |

| Certificate of Origin | All goods | 1-2 business days | Specific format may be required |

| Phytosanitary Certificate | Agricultural products | 3-5 business days | Issued by accredited body |

| Import License | Certain regulated goods | Varies depending on product | Application required in advance |

| Packing List | All goods | Immediate | Detailed description of contents |

This table provides a general overview. Always confirm the specific requirements for your goods with Turkish customs or a qualified customs broker.

Common Documentation Pitfalls

Even seemingly minor documentation errors can cause shipments to be held at Turkish customs. Common problems include discrepancies between the declared value and supporting documentation, incorrect Harmonized System (HS) codes, and incomplete or illegible information.

These issues can trigger time-consuming investigations and potentially expensive fines. A careful review of all documentation before submission is essential to avoid these problems.

Navigating Turkey’s Digital Documentation Systems

Turkey has embraced digitalization in its customs processes. Using these platforms can significantly speed up clearance and minimize errors. These digital systems allow for electronic document submission, real-time shipment tracking, and direct communication with customs officials.

Mastering these tools is particularly important for businesses with high import volumes, improving efficiency and reducing the need for physical paperwork.

Turkey’s 2025 E-Commerce Customs Overhaul

Turkey’s 2025 e-commerce customs reforms significantly changed the import landscape. The tax-exempt threshold for shipments decreased from €75 to €30, now including freight costs. This resulted in a tax increase – from 20% to 30% for goods from the EU and from 30% to 60% for goods from other countries.

Implemented in December 2024, this change aimed to regulate small imports, impacting the March 2025 import figures, which reached $29.202 billion. With customs brokers handling about 92% of declarations, their expertise is crucial for navigating these stricter regulations.

These new rules have increased compliance costs. With border compliance expenses previously at $46 per shipment in 2019, these costs have likely risen since the reforms. Learn more here.

Establishing a Scalable Documentation Process

As your business expands, a well-organized documentation system becomes even more vital. Develop a system that enables easy record retrieval, efficient submission tracking, and clear team communication.

Consider using dedicated document management software, implementing standardized file naming, and creating regular backups. A robust system will simplify audits and ensure consistent compliance as your import/export activities grow. Investing in such a system is an investment in your long-term success in Turkey.

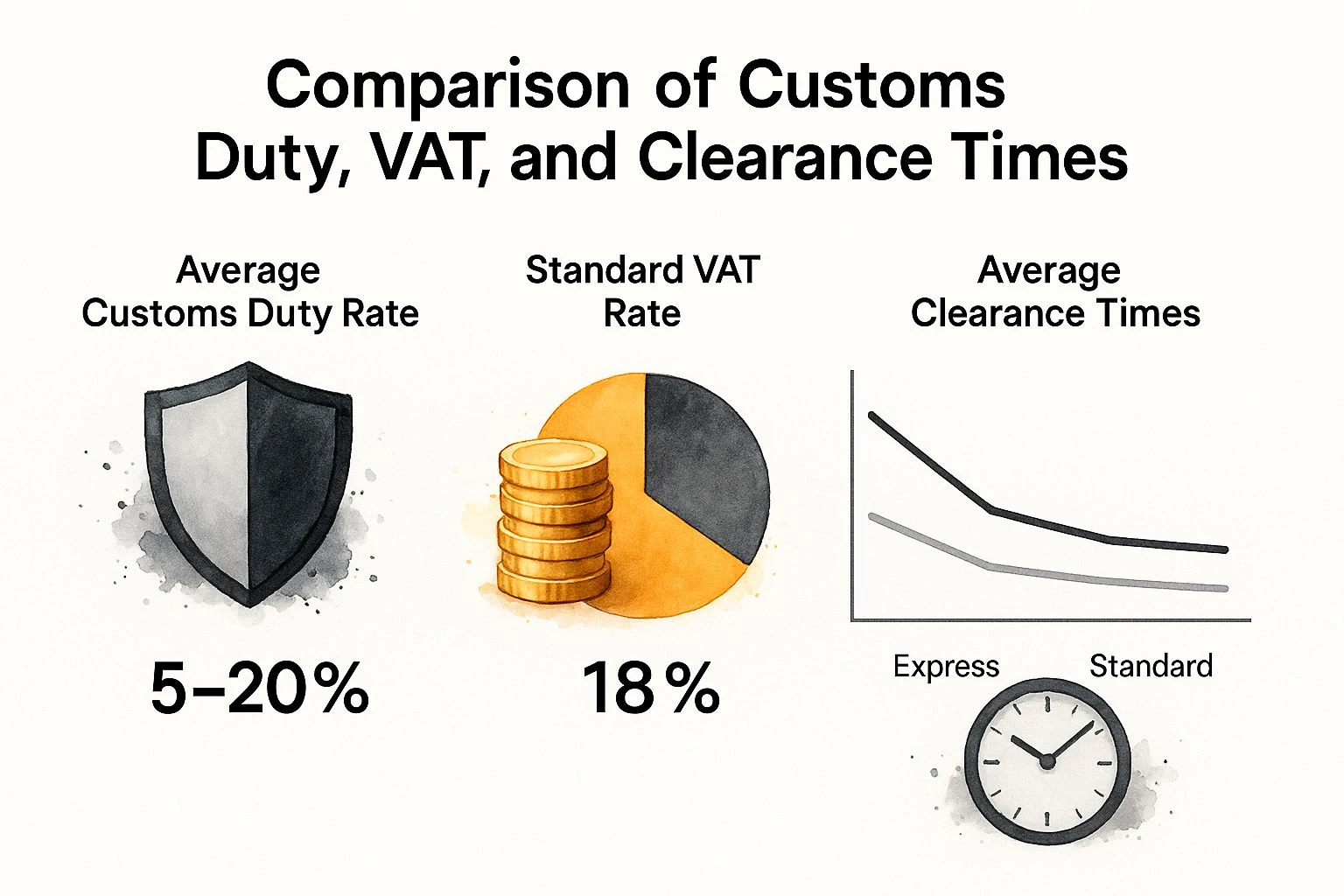

Customs Duties & Taxes: Strategic Approaches for Cost Control

Visual summary of Turkey’s customs duty rates (5–20%), standard VAT (18% – updated to 20%), and average customs clearance times by shipping type.

Managing customs costs effectively is crucial for profitability when importing into Turkey. A deep understanding of the duty structure and strategic planning are essential. This means going beyond simply knowing the rates. Instead, businesses must leverage practical approaches to optimize customs expenses.

This section explores how successful importers minimize their duty exposure while remaining compliant with Turkish regulations.

Mastering Product Classification for Optimal Duty Rates

One of the most impactful strategies for controlling customs costs is accurate product classification. The Harmonized System (HS) codes assigned to your goods directly determine the applicable duty rates. Even slight variations in classification can result in significant cost differences.

For example, a product incorrectly classified under a category with a higher duty rate can unnecessarily inflate import expenses. Therefore, meticulous attention to detail and a thorough understanding of HS codes are essential for maximizing cost savings.

Navigating Turkey’s VAT and Special Consumption Tax

Beyond import duties, Value Added Tax (VAT) is another significant cost component. The standard VAT rate in Turkey is currently 18%. However, certain goods and services may be subject to reduced rates or exemptions.

Additionally, certain products, like tobacco, alcohol, and fuel, are subject to Special Consumption Tax (SCT). Accurately calculating and managing both VAT and SCT is vital for predictable financial planning and avoiding unexpected expenses.

Leveraging Duty Exemptions and Free Trade Agreements

Turkey offers various duty exemptions and participates in several free trade agreements. These can significantly reduce or even eliminate import duties on certain products or for specific countries of origin.

Successfully leveraging these exemptions and agreements requires careful research and meticulous documentation. However, the potential cost savings can be substantial, resulting in a more competitive landed cost for your goods and providing an edge in the Turkish market.

Customs Valuation Methods and Documentation

The customs valuation of your goods forms the basis for calculating import duties. Turkish customs officials generally accept various valuation methods, including transaction value, deductive value, and computed value.

Choosing the appropriate method and meticulously documenting your calculations can help avoid challenges during customs clearance. Precise documentation also ensures transparency and builds trust with customs authorities.

Calculating Landed Costs for Effective Financial Planning

Accurately calculating your landed cost is crucial for informed decision-making. The landed cost is the total cost of a product once it has arrived at its destination. This includes not only duties and taxes but also freight, insurance, and other related expenses.

By accurately projecting these costs, businesses can better manage their cash flow, price their goods competitively, and avoid financial surprises.

To help illustrate the typical duties and taxes applied to imported goods in Turkey, the table below provides a general comparison across various product categories. Note that these are examples and actual rates can vary.

To better understand the typical duties and taxes on imported goods, refer to the comparison table below. It outlines general examples across several product categories; however, keep in mind that actual rates may differ.

Customs Duties and Taxes Comparison by Product Category

| Product Category | Import Duty Rate | VAT Rate | Special Consumption Tax | Total Tax Burden (Estimate) |

|---|---|---|---|---|

| Textiles | 10% | 18% (updated to 20%) | – | 28% |

| Electronics | 5% | 18% (updated to 20%) | – | 23% |

| Automotive Parts | 7% | 18% (updated to 20%) | – | 25% |

| Alcoholic Beverages | 20% | 18% (updated to 20%) | 50% | 88% |

| Tobacco Products | 30% | 18% (updated to 20%) | 60% | 108% |

This table provides a simplified overview of the potential tax implications for different product categories imported into Turkey. The total tax burden is an estimate and can vary depending on the specific product and its classification. Consulting with a customs expert is recommended for accurate calculations.

Recent Changes in Turkish Customs Regulations

Recent regulatory changes in Turkey have emphasized the importance of strategic customs management. Starting December 2024, Turkey mandated the inclusion of freight costs in customs valuations, leading to stricter scrutiny and potentially higher duties for importers. This change aligns with the elevated import figures of $29.202 billion recorded in March 2025. Revaluation rates also updated fines for customs irregularities, increasing penalties for non-compliance. For more details, see Türkiye’s 2025 Customs Regulations.

Infographic: Impact of Recent Customs Reforms on Costs

The following data chart illustrates the impact of recent changes in Turkish customs regulations on the total cost of imported goods across various product categories.

(Infographic will be placed here)

The chart highlights several key trends. Electronics and textiles experienced the most significant cost increases due to the new regulations. Conversely, the agricultural sector saw a relatively smaller impact, likely due to existing exemptions or preferential tariffs. Overall, the chart reveals a trend of increasing costs across most categories, emphasizing the need for businesses to adapt their customs strategies.

By understanding these key areas and proactively adapting to regulatory changes, businesses can develop a robust strategy for managing customs duties and taxes in Turkey. This allows for cost optimization while ensuring full compliance.

Streamlining Your Customs Clearance Experience

A Turkish customs official conducts an inspection of cargo at the border, ensuring compliance before clearance is approved.

Efficiently moving goods through Turkish customs requires more than simply understanding the procedures. It takes strategic planning, meticulous preparation, and a practical understanding of the factors that can impact your import timeline. This section explores techniques experienced importers use to expedite customs clearance in Turkey.

Pre-Arrival Planning: Setting the Stage for Success

Effective customs clearance starts well before your goods arrive in Turkey. Pre-arrival planning is critical. This means ensuring all necessary documentation is complete, accurate, and easily accessible. It also requires a clear understanding of the specific customs procedures relevant to your product type.

For instance, certain goods might need special import licenses or certifications. Securing these beforehand can prevent significant delays upon arrival. This proactive approach establishes a solid base for a smooth and efficient customs process.

Mastering Declaration Submissions: Accuracy is Key

The customs declaration is the central document for clearing goods. Errors or inconsistencies can cause immediate delays. Accurate and complete declarations are therefore essential. Using Turkey’s online platforms for electronic submissions can expedite the process and reduce the risk of human error.

This involves paying close attention to details like correct HS codes, accurate valuations, and clear product descriptions. This precision helps prevent unnecessary scrutiny and allows your shipments to move swiftly through customs.

Inspection Preparation: Be Ready for Anything

Not all shipments are inspected, but being prepared for the possibility is crucial. Ensure your goods are packaged and labeled correctly, enabling customs officials to easily access and verify the contents. Having organized supporting documentation readily available streamlines the inspection process.

Understanding the specific criteria customs officials look for can also help you anticipate and proactively address potential problems. This preparation minimizes delay risks and demonstrates a commitment to compliance.

Navigating Clearance Channels: Green, Yellow, and Red

Turkish customs uses a three-channel system: green, yellow, and red. Green signifies minimal scrutiny, allowing goods to pass through quickly. Yellow involves document review and possible physical inspection. Red designates a full examination of both documents and goods.

Understanding which channel your shipment is likely to fall into, and preparing accordingly, is key. This helps manage expectations and enables appropriate resource allocation for each stage of the process.

Building a Positive Compliance History

Consistent compliance with Turkish customs regulations is the best way to streamline future clearances. A positive compliance history builds trust with officials and can result in faster processing. This involves maintaining detailed records of all transactions, responding promptly to customs inquiries, and addressing any issues efficiently.

Demonstrating a commitment to compliance helps businesses cultivate a strong reputation with Turkish customs, creating a smoother, more efficient long-term clearance experience. This proactive approach fosters trust and simplifies future transactions.

Resolving Bottlenecks: Quick Action is Crucial

Even with meticulous planning, delays can happen. Knowing how to address these bottlenecks quickly is essential. Establish clear communication with your customs broker or freight forwarder, understand the reason for the delay, and provide necessary information promptly. This responsive approach helps get shipments back on track quickly and minimizes the impact of unexpected problems.

Working effectively with your customs broker, and understanding their role, is crucial for smooth customs clearance in Turkey. These professionals provide specialized knowledge and experience, making them invaluable for navigating Turkey’s complex customs landscape. Consider services like Workon for support with Turkish customs regulations.

By mastering these techniques, you can transform customs clearance in Turkey from a potential obstacle into a well-managed process. This proactive approach not only saves time and money, but also enables your business to operate more effectively in the Turkish market.

Leveraging Special Customs Regimes for Business Advantage

Navigating Turkey’s customs landscape effectively requires a solid understanding of the various special customs regimes available. These regimes offer significant advantages, helping businesses optimize supply chains, manage costs, and boost competitiveness. Let’s explore how companies are strategically using these regimes to their advantage.

Bonded Warehousing: Managing Inventory and Costs

Bonded warehousing allows businesses to store imported goods without paying duties or taxes until the goods are released for sale. This is particularly beneficial for managing inventory costs, especially for goods not immediately needed. Duty payments are deferred until the goods are sold or used, which improves cash flow.

For example, a company importing seasonal products can store them in a bonded warehouse and only pay duties and taxes when released closer to peak season. This provides flexibility and avoids tying up capital unnecessarily. Effective bonded warehousing requires careful planning and inventory management.

Inward Processing Relief: Boosting Manufacturing

Inward Processing Relief (IPR) allows importing goods temporarily for processing or manufacturing without paying immediate import duties. This is a valuable tool for manufacturers in Turkey, enabling competitive sourcing of materials and components from international markets. Duties are payable only on the finished goods.

This is particularly advantageous for exporters, making their products more price-competitive globally. However, using IPR involves detailed record-keeping and adherence to specific customs procedures.

Free Zones: Optimizing Supply Chain Economics

Turkey offers several free zones with special customs and tax benefits. Businesses operating in these zones enjoy a streamlined customs environment and various incentives, including exemptions from certain duties and taxes.

Free zones are particularly effective for establishing regional distribution centers or manufacturing facilities. Companies can store, process, and re-export goods with minimal administrative burden, reducing costs and processing time. Businesses considering free zones should carefully assess the specific regulations of each zone.

Maintaining Compliance with Special Regimes

While the benefits of these special regimes are significant, businesses must meet specific criteria to qualify. This often includes demonstrating intended use of the goods, providing financial guarantees, and maintaining meticulous records.

Ongoing compliance is crucial. Failing to adhere to regulations can result in penalties and loss of benefits. Partnering with experienced customs brokers like Workon can help navigate these complexities and ensure compliance.

Measuring the ROI of Special Customs Regimes

Evaluating the return on investment (ROI) of these regimes requires a strategic approach. Businesses should weigh the short-term compliance costs against the long-term financial benefits, including the impact on inventory costs, duty payments, supply chain efficiency, and overall competitiveness.

By carefully considering these factors and implementing a robust customs strategy, businesses can fully leverage Turkey’s special customs regimes for a more efficient and profitable operation.

Overcoming Customs Challenges: Proven Problem-Solving Approaches

An antique vase prepared for international shipping, representing complex customs clearance procedures and resolution strategies in Turkey.

Even with meticulous planning, unforeseen challenges can arise during the customs clearance process in Turkey. Understanding how to address these hurdles effectively is crucial for maintaining smooth and efficient import operations. This requires proactive strategies designed to resolve common problems. This section explores proven solutions for navigating these import complexities.

Addressing Classification Disputes

One common source of delays is disagreements over product classification and the assigned HS codes (Harmonized System codes). These disputes can significantly impact the applied duty rates, potentially leading to unexpected costs. A solid understanding of the Harmonized System and maintaining detailed product specifications are vital for supporting your chosen classification.

If a dispute arises, clear communication with Turkish customs officials is essential. Providing supporting documentation, such as technical datasheets or product catalogs, can help resolve the issue. Engaging a customs broker experienced in classification appeals can also strengthen your position. Workon offers expert assistance in navigating these often complex situations.

Resolving Valuation Disagreements

Valuation disagreements, where customs officials question the declared value of imported goods, can also lead to delays. Thorough documentation of your valuation methodology, including supporting invoices, purchase orders, and transport costs, is key to preventing these disputes. This transparent approach substantiates your declared values.

Should a disagreement occur, presenting a well-documented case aligned with accepted valuation methods becomes critical. This preparation demonstrates due diligence and supports your argument for a fair and accurate valuation.

Expediting Release of Held Shipments

Shipments can be held for various reasons, ranging from documentation errors to missing permits. When a shipment is held, swift action is essential. Contact Turkish customs or your broker immediately to understand the reason for the hold. Providing the necessary information promptly can expedite the release, minimizing storage fees and supply chain disruptions.

Managing Post-Clearance Audits

Post-clearance audits are a regular part of customs procedures. Being prepared for these audits is vital for uninterrupted operations. Maintaining organized records of all import transactions, including declarations, invoices, and payment documents, is fundamental. This organization simplifies the audit process, allowing you to provide required information efficiently.

Building Productive Relationships & Overcoming Language Barriers

Cultivating positive relationships with Turkish customs officials can significantly contribute to long-term import success. Clear, respectful communication is paramount. Partnering with a bilingual customs broker familiar with Turkish business culture can be invaluable, especially in complex situations. Workon offers reliable customs brokerage and other business services within Turkey.

Navigating Seasonal Congestion and Proactive Compliance

Major Turkish ports can experience significant congestion during peak seasons. Strategic shipment planning, considering alternative ports, and submitting declarations in advance can mitigate delays. Proactive compliance, including meticulous documentation and adherence to regulations, minimizes the risk of holds and inspections. These proactive strategies help ensure smooth customs clearance, even during peak times.

Building Your Customs Clearance Dream Team

Successfully navigating customs clearance in Turkey depends significantly on the relationships you build. Your customs broker and freight forwarder are essential partners in your import process. Choosing and managing these partners effectively can greatly influence your success in the Turkish market.

Evaluating Potential Partners

When selecting a customs broker and freight forwarder, don’t just focus on basic services. Consider their experience with similar products, their understanding of Turkish regulations, and their relationships with customs officials. A strong partner understands the complexities of documentation and can anticipate potential issues.

For instance, if you’re importing specialized goods like pharmaceuticals or electronics, choose a broker with proven expertise in that area. This specialized knowledge ensures they can manage the specific licenses, permits, and documentation your products require.

Establishing Performance Metrics

Set clear performance metrics for your customs partners. These could include clearance times, documentation accuracy, communication responsiveness, and cost-effectiveness. Regularly monitoring these metrics ensures you receive optimal service and achieve your import objectives.

Open and consistent communication is also vital. Establish dedicated channels for updates and problem-solving. This helps minimize delays and keeps your imports running smoothly.

Structuring Relationships for Success

Design agreements with your customs partners to align incentives. This could involve performance-based bonuses or penalties for delays. A well-structured agreement encourages your partners to prioritize your shipments and maintain high standards. Their success directly contributes to yours.

This collaborative approach fosters proactive communication. Partners are more likely to identify potential issues early if they understand the shared responsibility for successful customs clearance.

Internalizing vs. Outsourcing Customs Functions

Some companies might consider handling customs functions internally. However, outsourcing to experienced brokers often offers significant advantages. Brokers possess in-depth knowledge of Turkish customs regulations and stay updated on regulatory changes. This expertise can save you time and money, while reducing compliance risks.

Developing Institutional Knowledge

Even with outsourcing, building internal knowledge within your company is crucial. This involves understanding basic customs procedures, key regulations, and documentation requirements. This foundational knowledge helps you effectively communicate with your customs partners and monitor their performance.

Leveraging External Expertise for Complex Situations

While maintaining basic internal knowledge is important, complex situations often demand external expertise. A skilled customs broker can offer invaluable support in resolving disputes, navigating regulatory updates, or handling specialized import/export issues. Their deep understanding of Turkish customs procedures becomes a key asset for your business.

For comprehensive guidance on navigating customs clearance procedures in Turkey, consider Workon. While only licensed customs brokers can execute clearance, Workon provides expert advisory services to help businesses prepare documentation, understand compliance requirements, and coordinate effectively with customs agents. Our services also include company formation, trade consulting, and other essential business setup support in the Turkish market.

👉 Learn more about our Customs Process Advisory Services in Turkey

Disclaimer:

This article is for informational purposes only and does not constitute legal, tax, or customs brokerage advice. While every effort has been made to ensure accuracy, Turkish customs regulations and procedures may change frequently. For specific guidance related to your import/export operations, we recommend consulting a licensed customs broker or a qualified legal advisor. Workon offers advisory services to help businesses navigate customs processes in Turkey but does not directly provide customs clearance services.