Setting up a company in Turkey is a smart move if you’re looking to build a strong case for residency. It’s not a golden ticket, but it’s a powerful way to show you’re serious about putting down roots and contributing to the local economy. For entrepreneurs and investors ready to get involved, this path makes a lot of sense.

Unlocking Residency Through Your Turkish Business

Many people think starting a business here automatically grants them a residence permit. The reality is a bit more complex. Think of it as a strategic stepping stone, not an automatic pass. The crucial detail is your role in the company. Are you a hands-off shareholder or an active, day-to-day director? This distinction determines which permit you should be aiming for.

Simply registering a name and getting a tax number won’t cut it. The immigration authorities want to see a real, operational business, not just a shell company set up for a visa. This is where the shareholder versus director role becomes so important. If you’re a shareholder who isn’t involved in the daily management, your immediate goal is the short-term residence permit. This permit allows you to live in Turkey legally based on your investment. For those who plan to be actively running the show, a work permit will be the next logical step.

From Shareholder to Resident

Your first big hurdle is proving you’re a genuine business owner. When you apply for that initial short-term residence permit, you’ll need to present official documents from the Turkish Commercial Registry that clearly name you as a shareholder. This is non-negotiable. But the paper trail doesn’t stop there. The officials will be looking for other signs that your business is legitimate and operational. You’ll need to show things like:

- A proper, registered business address (not just a P.O. box).

- A corporate bank account with the required share capital paid in.

- A realistic business plan that spells out what your company actually does.

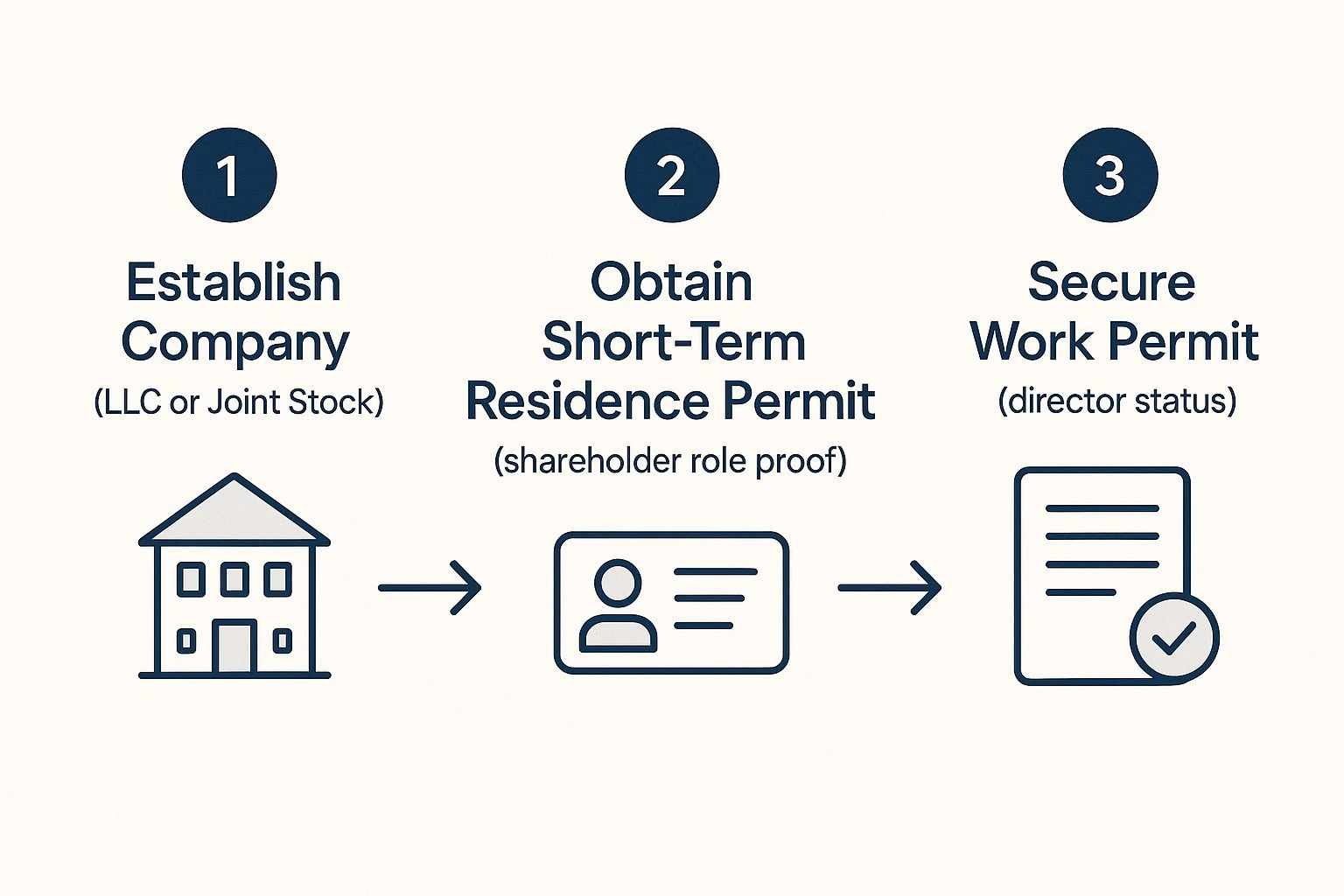

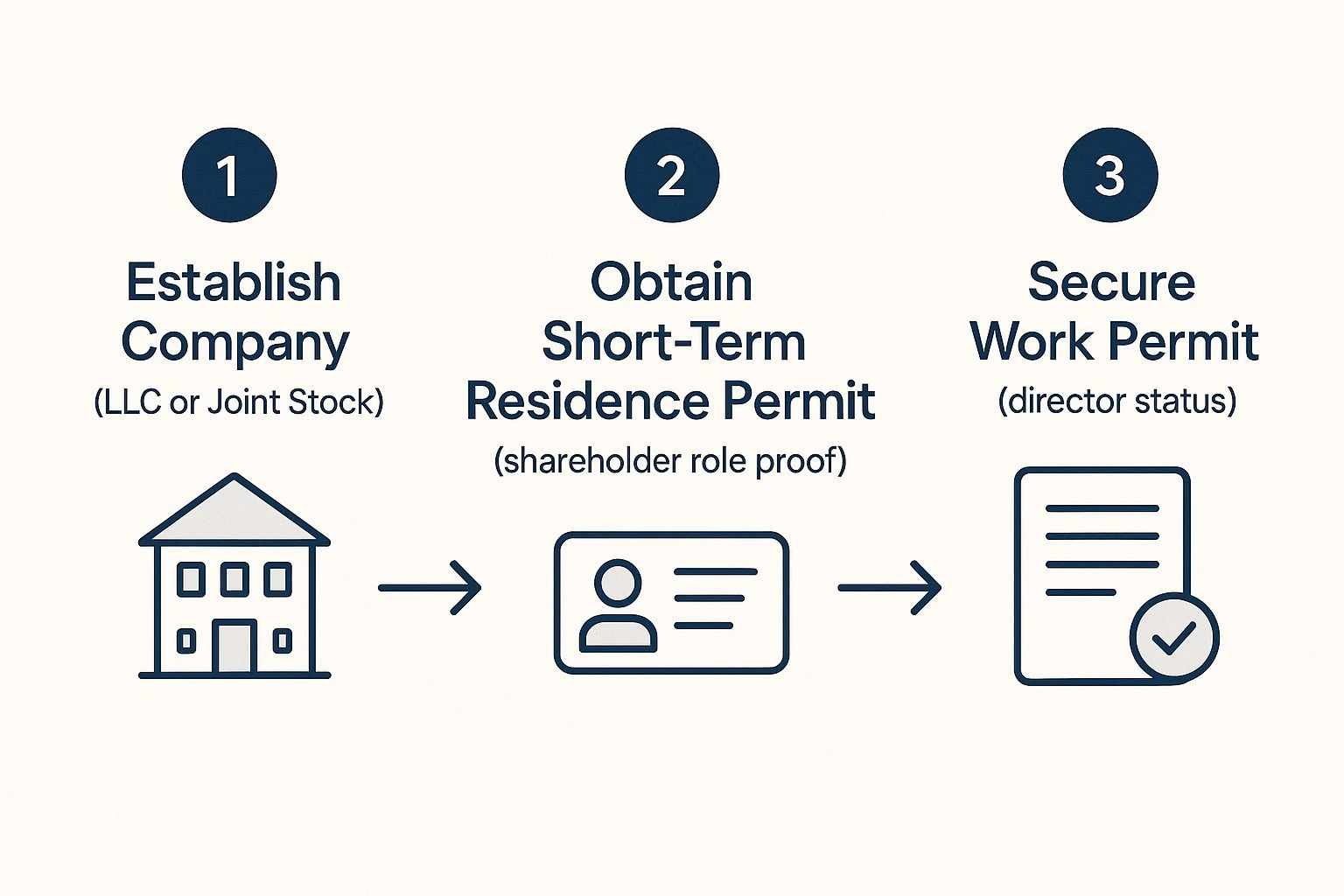

This infographic gives a good visual overview of how you progress from company formation to securing your permits. As you can see, establishing the company is the critical first step. It’s the foundation that all your other permit applications will be built upon.

Visual Guide: Company Formation, Residence Permit, and Work Permit

Comparing Residency Routes Company vs Real Estate

For many foreign investors, the choice comes down to either establishing a business or purchasing property. Both are viable paths to residency, but they cater to different goals and circumstances. I’ve put together a quick comparison to help you see which might be a better fit for you.

| Attribute |

Company Ownership Path |

Real Estate Investment Path |

| Primary Goal |

Active business engagement, economic contribution |

Lifestyle, passive investment, personal use |

| Minimum Investment |

No official minimum, but requires substantial capital to appear legitimate |

$200,000 in designated cities for residency purposes |

| Application Strength |

Demonstrates strong, ongoing economic ties to Turkey |

Shows financial commitment and a stable local address |

| Complexity |

Higher; involves company registration, accounting, and compliance |

Lower; straightforward property purchase and title deed transfer |

| Ongoing Effort |

Requires active management and adherence to Turkish commercial law |

Minimal; property taxes and maintenance |

| Permit Type |

Typically a renewable short-term residence permit |

Short-term residence permit based on property ownership (TAPU) |

While the real estate route is often seen as more straightforward, a well-run company can provide a more compelling and sustainable reason for your long-term presence in the country, especially if you plan to eventually seek citizenship.

Setting Realistic Expectations

It’s vital to go into this with your eyes wide open. The company you form is the justification for your residency application. Immigration officials need to see a real, functioning business that adds value.

My Takeaway: Your company isn’t just paperwork; it’s your story. It tells the authorities why you should be allowed to live in Turkey. A business that hires locals, pays taxes, and actively trades is the best proof you can offer.

Navigating Turkish residency rules can be a challenge, as regulations are updated periodically. Staying on top of the latest requirements is absolutely essential. To help you stay informed, we’ve put together a detailed overview of the Turkish residence permit new rules for 2025. Being prepared from the start will save you a world of headaches later on.

Laying the Groundwork: Strategically Forming Your Turkish Company

This is it—the most critical, hands-on part of your journey. Setting up your company is where your plans become a reality, creating the legal entity that will underpin your entire residence permit application. Frankly, getting this stage right is non-negotiable. Any slip-ups here can cause headaches and serious delays down the road.

Professional Setup for Establishing a Business in Turkey

The very first decision on your plate is choosing the right business structure. For most foreign investors I’ve worked with, it usually comes down to two main options. Each has its own pros and cons, and the best fit really depends on what you’re trying to build.

Limited Liability vs Joint Stock Company: Making the Right Call

Most people opt for a Limited Liability Company (LTD or Limited Şirket). It’s the go-to for small to medium-sized businesses in Turkey for a reason. It’s flexible, and the minimum share capital is just 50,000 TRY, making it a very accessible and sensible choice for entrepreneurs who want a straightforward setup.

Then you have the Joint Stock Company (A.Ş. or Anonim Şirket). This is more for the big players—larger-scale operations or businesses that might want to go public one day. The bar is higher here, with a minimum capital requirement of 250,000 TRY and stricter governance rules. Honestly, for residency purposes, an LTD is almost always the most efficient path forward.

Let’s break it down simply:

- Go with an LTD if: You’re a solo founder or have a few partners, your business model isn’t overly complex, and you’d prefer to keep initial costs and management duties light.

- Think about an A.Ş. if: Your business plan involves serious capital, you plan to sell shares to raise funds, or your corporate structure needs a formal board of directors.

Simplify your business setup with Workon’s all-in-one company registration service in Turkey.

Your Business Plan Is Not Just a Formality

Before you even think about registering anything, you need a rock-solid business plan. This isn’t just a roadmap for you; it’s a crucial piece of evidence for the immigration authorities. They need to see that your company is a legitimate, well-thought-out venture that can actually contribute to the Turkish economy. Your plan absolutely must detail:

- The core purpose of your business and what you’ll be selling.

- A realistic financial forecast—think revenue projections, overheads, and cash flow.

- A clear picture of your target market and how you’ll reach them.

- Your day-to-day operational strategy.

Trust me on this: a vague or generic plan is a massive red flag. The officials reviewing your case need to be completely convinced that you’re building a real business, not just a shell company to get a residence permit.

Getting Your Initial Residence Permit Sorted

With your Turkish company officially up and running, the focus shifts from the business itself to your personal legal status. This is where you leverage your new business ownership to secure your right to live in Turkey. Getting this part right requires careful preparation, as even minor mistakes with your paperwork can lead to frustrating delays or an outright rejection.

Organizing your documents for a successful residence permit application through company ownership.

The first real task is to pull together a solid application package. While everyone needs the standard personal documents, your application has to pivot around your new role as a business owner. You’re not just applying for residency; you’re presenting a case to the immigration authorities that proves you’re a genuine investor who’s contributing to the Turkish economy.

Building Your Business-Backed Application

Your application needs to tell a single, coherent story. The most important evidence you’ll provide are the documents directly linked to your new company. Think of it as connecting the dots for the official reviewing your file, drawing a clear line from your registered business to your request to live here.

The essential business documents you’ll need are:

- Notarised Company Activity Certificate: This comes from the Chamber of Commerce and proves your company is active and in good standing.

- Notarised Tax Registration Certificate: This shows your company is registered with the tax authorities and ready to do business legally.

- Notarised Trade Registry Gazette: The official publication that announced your company’s formation, with your name listed as a shareholder.

- Notarised Signature Circular: This document officially confirms who has the authority to sign on the company’s behalf.

Of course, you’ll need to pair these with your personal documents. This list is just as important and demands close attention to detail. To steer clear of common mistakes, make sure you have every single item on this list ready to go—and correctly formatted—before you even think about starting the online application.

- Residence Permit Application Form: This is generated from the e-İkamet online system. You’ll need to complete and sign it.

- Passport: The original, plus a clear copy of your main ID page and the page showing your most recent entry stamp into Turkey.

- Four Biometric Photographs: They must be new (taken within the last six months) and meet the specific government standards. Don’t try to use old ones.

- Valid Health Insurance: It absolutely must be a Turkish policy covering the entire period you’re applying for. Foreign insurance policies won’t cut it.

- Proof of Address: A notarised rental contract is standard. If you’ve bought property, a copy of your title deed (TAPU) will work.

- Proof of Sufficient Financial Means: Bank statements are key here. You need to show you can support yourself (and your family, if applicable) for your entire stay.

A Quick Tip From Experience: The proof of funds isn’t just a box to tick. The authorities genuinely want to see that you won’t be a financial drain. Showing a healthy balance in your personal Turkish bank account, on top of your company’s capital, makes a far more convincing argument than just scraping by the minimum requirement.

It can be useful to see how Turkey’s requirements stack up against others. For some perspective, you can look at the investor visa requirements from other countries.

Keeping Your Company and Residency Afloat

Getting that initial residence permit is a huge milestone, but don’t pop the champagne just yet. Think of it as the starting line, not the finish. The Turkish government gave you that permit based on the promise of an active, contributing business, and now you have to deliver. Staying on top of your company’s legal and financial obligations is the key to successfully living and working in Turkey long-term.

Managing tax filings, Bağ-Kur payments, and permit renewals to maintain legal residency status.

Your company can’t just exist on paper. It needs to be a living, breathing entity that generates revenue and, crucially, plays by the rules. Dropping the ball here won’t just risk your business; it could put your entire life in Turkey in jeopardy.

The Lifeline: Ongoing Corporate Compliance

Picture your company’s compliance as the foundation of your residency. If cracks start to appear in that foundation, the whole structure becomes unstable. From my experience, there are two areas you absolutely cannot afford to neglect.

First up is tax filings. In Turkey, this isn’t a once-a-year headache. Depending on your company type, you’ll be dealing with monthly, quarterly, and annual tax declarations. Keeping these submissions timely and accurate is your best proof that your business is legitimate and contributing to the local economy. It’s a clear signal to the authorities that you’re a serious investor.

The second, equally critical piece, is your social security (Bağ-Kur) contributions. As a company owner or partner, you’re on the hook for this. Falling behind on Bağ-Kur payments is a massive red flag, and it’s one of the first things officials check when you ask to renew your permit.

A Word of Warning: Don’t assume the immigration office and the tax office don’t talk to each other. They do. A problem in your company’s tax or social security history will almost certainly create a major roadblock when it’s time to renew your residence permit.

Renewing Your Short-Term Residence Permit

Most initial permits are valid for one or two years. The renewal clock starts ticking early—you need to file your extension application within the 60-day window before your current permit expires. The process feels a lot like the first time around, but with a new focus: they want to see what your company has actually been doing.

When you gear up for renewal, you’ll be gathering updated versions of your original paperwork, plus a fresh batch of documents to prove your company has been active and compliant. Be prepared to provide:

- An updated Company Activity Certificate to show your business is in good standing.

- Your most recent tax filings to prove you’ve met your financial duties.

- Bağ-Kur payment records demonstrating that your social security is all paid up.

- Current bank statements (both personal and corporate) to show you’re still financially stable.

Turkey’s appeal to foreign investors isn’t slowing down, and a thriving community of foreign entrepreneurs is a big part of that success. While setting up the business is the first step, it’s just one part of a much bigger picture. You can find more details about the foreign residency landscape in Turkey on immigrantinvest.com.

Ultimately, staying ahead of the game is the only way to play. Treat your corporate responsibilities with the same urgency as your immigration filings. This proactive approach builds a solid, compliant presence that will allow you to enjoy your life and business in Turkey for years to come.

Ticking the Administrative Boxes

With your structure and plan in place, it’s time for the paperwork. This part is all about following a sequence of official steps in the correct order. While owning a company isn’t a golden ticket to residency, it provides a very strong foundation. The process involves getting a Turkish tax ID, registering with the right trade bodies, and potentially hiring staff. It can get complicated, and this is where having local legal help is invaluable.

The main milestones you’ll need to hit are:

- Get a Potential Tax ID Number for every foreign shareholder and director.

- Draft and Notarise the Articles of Association—this is your company’s official rulebook.

- Open a Corporate Bank Account specifically for the business.

- Deposit the Required Share Capital directly into that new account.

Insider Tip: Don’t underestimate the bank account step. Turkish banks are very thorough with their due diligence on foreign-owned companies. Showing up with all your documents perfectly organised will save you an incredible amount of time and frustration.

As you budget for your new venture, look beyond just the registration fees. Your online presence is a key operational cost. For a good breakdown of what to expect, this guide on small business website cost offers some great real-world insights for your initial planning. For a more granular look at these steps, you can explore our complete company formation in Turkey guide.

Getting Your Work Permit: The Rules for Business Owners

Once you have your residence permit, you can legally live in Turkey, but that’s where it stops. It doesn’t give you the right to work—not even in the company you just founded.

If you plan to be hands-on with your business—signing contracts, managing staff, or making key decisions—you absolutely need a work permit. This permit comes from the Ministry of Labour and Social Security, and their standards are much stricter than what you went through for residency.

The government sees a work permit for a business owner as a serious matter. They need to be convinced your business is legitimate and substantial enough to justify having a foreign national in charge. This is a common stumbling block for entrepreneurs who assume it’s just a formality. Getting this part right is what makes or breaks your plan for residency through company ownership in Turkey.

The Two Golden Rules: Capital and Staffing

The Ministry has a couple of non-negotiable rules for foreign partners looking for a work permit. The most important ones are about your company’s money and your local team. Mess these up, and you’re looking at a swift rejection.

First, your company’s paid-in capital must be at least 100,000 TRY. The key phrase here is paid-in. This isn’t a pledge or a future promise; the cash has to be fully deposited into the company’s bank account and appear on the official books.

Second is the “five Turkish employees” rule, which trips up many people. For every foreign partner or manager applying for a work permit, your company must employ at least five Turkish citizens. This is how the government ensures your business directly benefits the local economy, and they don’t bend on this.

A Word From Experience: This is a classic rookie mistake. You can’t hire the five employees after you get your permit. They must be on your payroll, with their social security (SGK) contributions paid, at the very moment you submit your application.

For a deeper dive into the process, it’s worth reading up on the specifics of the Turkish work permit.

Common Questions About Securing Residency Through a Turkish Company

When you’re looking to build a life in Turkey by starting a business, you’re bound to have questions. It’s completely normal. Getting clear on the details from the outset is the best way to avoid any nasty surprises or delays down the road. Let’s walk through some of the most common queries we hear from entrepreneurs.

What’s the Real Minimum Investment I Need for Residency?

This is usually the first question on everyone’s mind, and it’s a smart one. While you can technically form a limited company (LTD) with a minimum share capital of just 50,000 TRY, that figure doesn’t tell the whole story.

For the purpose of getting a work permit as a company partner—which is crucial for your residency—the authorities want to see a more serious commitment. Your paid-in capital must be at least 100,000 TRY. Honestly, we always advise clients to invest a bit more. A healthier capital base makes your business look more credible and financially sound, which can genuinely strengthen your residency and work permit case.

Can I Bring My Family Over on My Business Residency Permit?

Absolutely. This is a huge plus for many entrepreneurs. Once your own residence permit is approved and in hand, you can act as a sponsor for your spouse and any children under 18. They can then apply for family residence permits.

It’s not a one-and-done deal, however. Each family member needs their own application, complete with a file of supporting documents. You’ll typically need to provide:

- Your official marriage certificate.

- The birth certificates for your children.

- Proof that you have the financial means to support your entire family.

- A valid, comprehensive health insurance policy covering each person.

The most important thing to remember is that your family’s residency status is completely dependent on yours. If your permit lapses, so do theirs. Keeping your own status compliant is the bedrock for your family’s life here.

Is This a Pathway to Turkish Citizenship?

For many, this is the ultimate goal. The short answer is yes, owning a business and living here can lead to citizenship, but it’s a marathon, not a sprint. This isn’t a direct “citizenship by investment” fast track.

To qualify for citizenship through naturalisation, you need to live in Turkey continuously for five years on a valid permit. And “continuously” is key—you can’t be out of the country for more than 180 days over that entire five-year stretch.

On top of the residency requirement, you’ll also have to show some basic proficiency in the Turkish language, have a clean criminal record, and demonstrate that you’re genuinely integrating into Turkish society. It’s a very different route from the faster programmes, like the one that requires a $400,000 real estate investment.

Figuring out all the nuances of company formation and residency can feel overwhelming. At Workon, our job is to make it simple. We handle everything from the initial company setup to securing your permits, making sure you hit every mark for a smooth transition to your new life in Turkey. Learn more about our services and let our team of experts take care of the details.

No. Company ownership alone doesn’t give automatic residency. You must apply for a short-term residence permit and prove your business is real, active, and properly registered.

You’ll need personal documents (passport, insurance, photos) plus company documents such as the Trade Registry Gazette, Tax Registration Certificate, Activity Certificate, and Signature Circular.

An LTD legally requires 50,000 TRY to form, but for a work permit as a foreign partner you must show at least 100,000 TRY paid-in capital. A higher amount strengthens your application.

Yes. After your residence permit is approved, your spouse and children under 18 can apply for family residence permits, provided you show financial means and valid insurance.

Yes—after five years of continuous residency with limited time spent abroad. You must also show integration, basic Turkish language proficiency, and a clean legal record.